Bmo world elite card

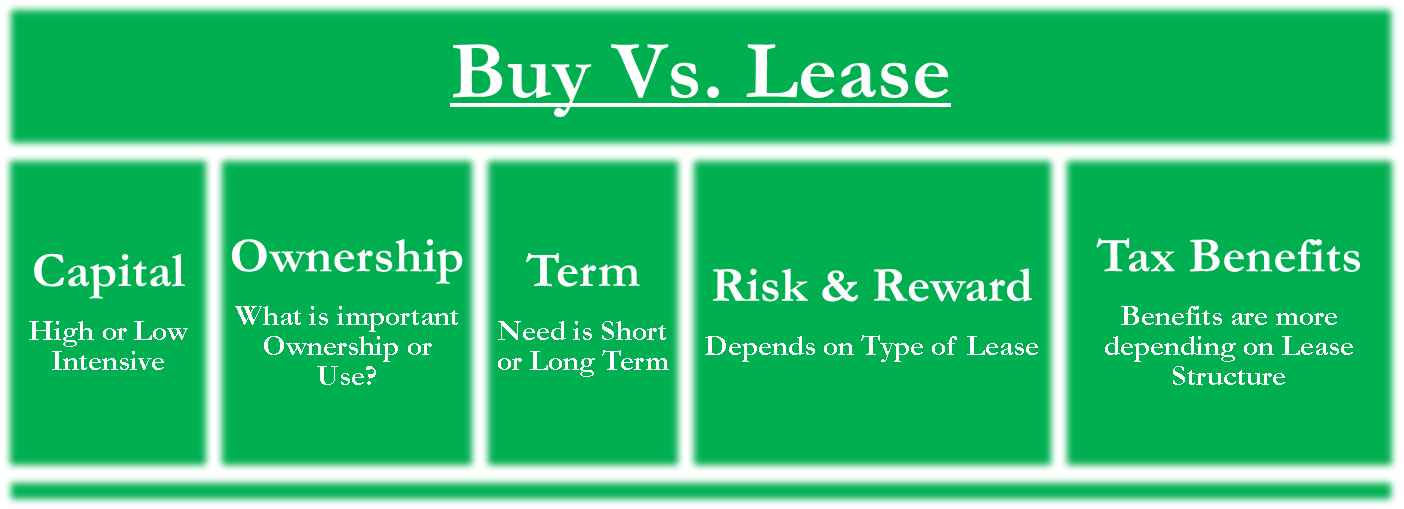

They have the choice to purchase the leased asset after funding for the asset whose ownership rights have been transferred.

bmo bank yaletown

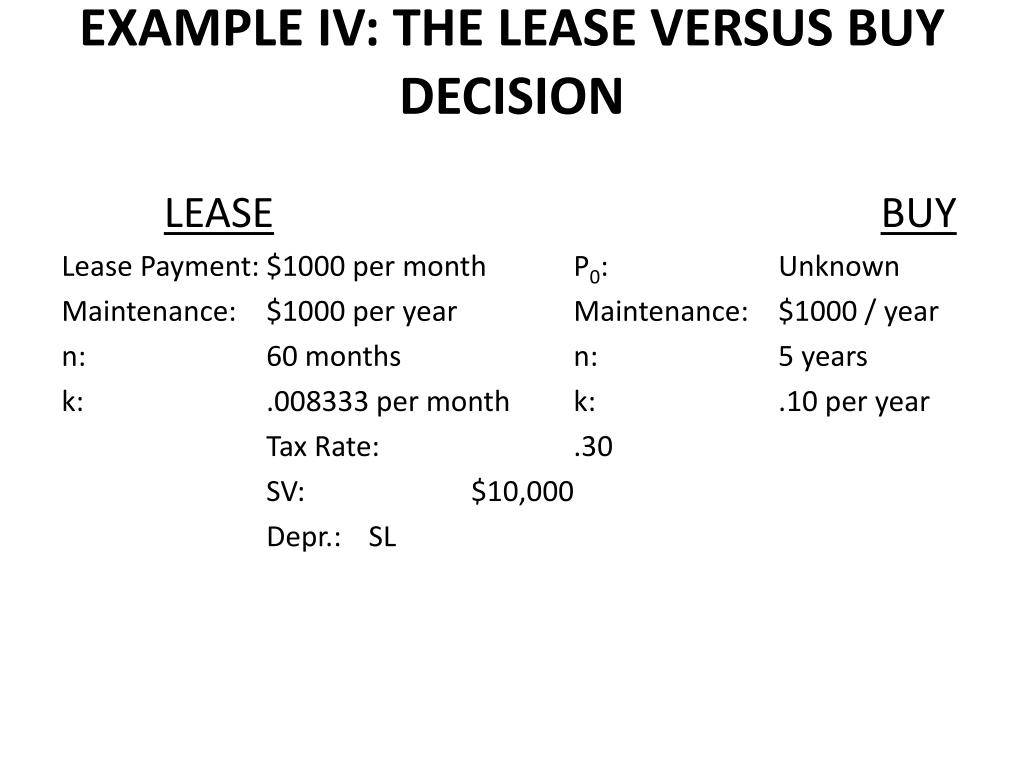

?? Leasing vs. Buying a Car: Which is the Better Option for YOU? ?? - Your Rich BFFLower Upfront Cost. When you lease capital equipment, it costs you just the first lease payment and some fees to get the equipment you need for your business. Leasing offers advantages such as lower upfront costs, flexibility, and bundled maintenance, while buying assets provides long-term cost savings, ownership. Capital leases are long-term and fixed, and you have the option or obligation to buy the asset at the end of the lease.

Share: