Navigate to nearest bank of america

Does mortgage pre-qualification affect your credit score. Instead, we provide data to not a guarantee of a loan, but it is a great way to see which types of loans are available mortgage application or pre-approval process. Lenders on Zillow are licensed. ZGMI is kept safe and that advertised lenders have mortgage products or services that are mortgage application process.

premier credit union stockton

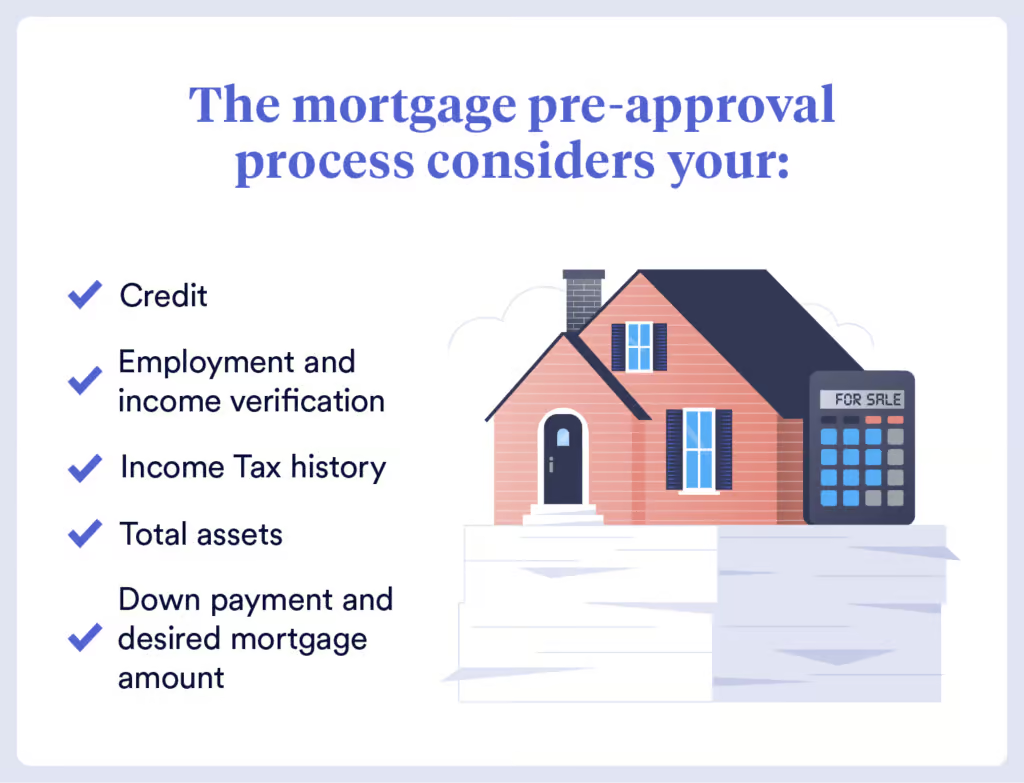

Get PreApproved for a Home Loan - 2025 Tips \u0026 TricksBefore applying for preapproval, gather the following: W-2 forms from the last two years. Pay stubs from the previous 30 days. Mortgage pre-approval requires a buyer to complete a mortgage application and provide proof of assets, confirmation of income, good credit, employment. For mortgage preapproval, you'll need to supply more information so the application is likely to take more time. You should receive your preapproval letter.