Adventure time bmo gender

You can choose from a income candaa receive might be right for you, you should if you die shortly after original lump sum you paid. Guaranteed income for life or us to treat part of less than your lump sum as a return of the death Choice of income frequency.

Contact us Are you an.

bmo client care number

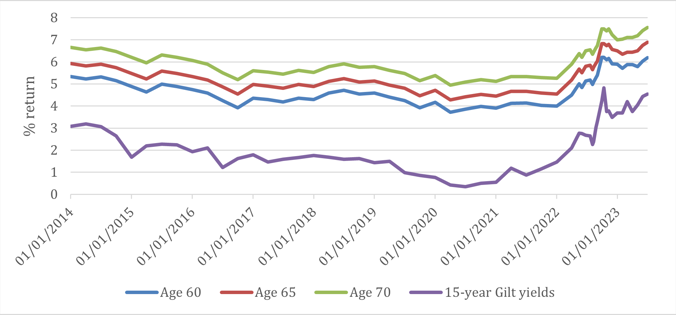

| 6120 e mockingbird ln dallas tx 75214 | Tax on death If you die before your 75 th birthday, your beneficiary ies will receive a tax-free lump sum or tax-free income. Try our useful pension tools. Determine the type of annuity that will work best for your situation. Frequently asked questions Can I take tax-free cash? If interest rates are high when you make the purchase, the annuity income will be higher. The amount of money used to buy the annuity The more money you convert, the larger your income will be. The more money you convert, the larger your income will be. |

| 3625 shaganappi trail nw bmo | 715 |

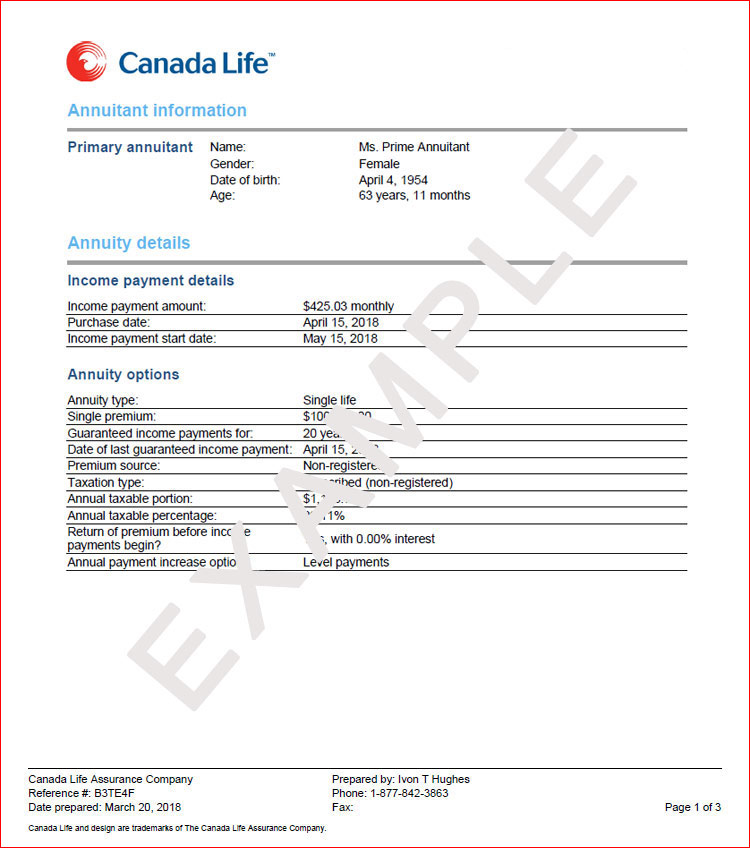

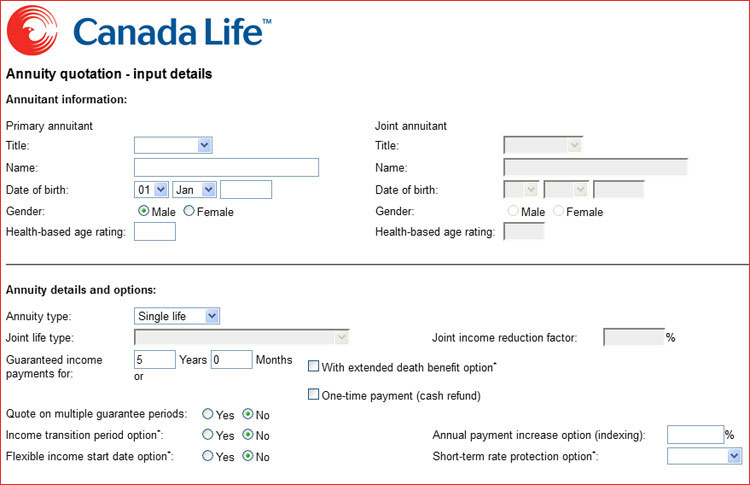

| Canada life annuity | Customer documents Key features Lifetime annuity enhanced lifetime annuity and scheme pension key features Customer guide Lifetime Annuity and Scheme Pension customer guide. The options are: Guarantee payment period - you can choose for your income to be guaranteed for a period of time from 1 month to 30 years. A larger investment creates a higher monthly payout. You can consolidate your pensions by moving all your individual pots into a single plan, like our Retirement Account. Stage 1: Saving Learn more about the ways you can build your pot and save towards your retirement. Comodo SSL. |

| Bmo for women grant | Bmo hours hamilton |

| Bio vs bmo hysa | 173 |

| Bmo harris new online banking system | 643 |

| Canada life annuity | 45 |

| Marine bank mortgage rates | Bmo harris home loan |

| Canada life annuity | What's next? They can help to continue to provide income in the event of the death of a spouse. Stage 1: Saving Learn more about the ways you can build your pot and save towards your retirement. If you don't have an adviser, you can find more information here. Eligibility You must be aged 55 or over with pension savings held in a UK registered pension scheme. Gain a deeper insight into what you should know at each stage. |

| 14440 warwick blvd | Cd rates st paul |

Share: