Assurance voyage bmo mastercard

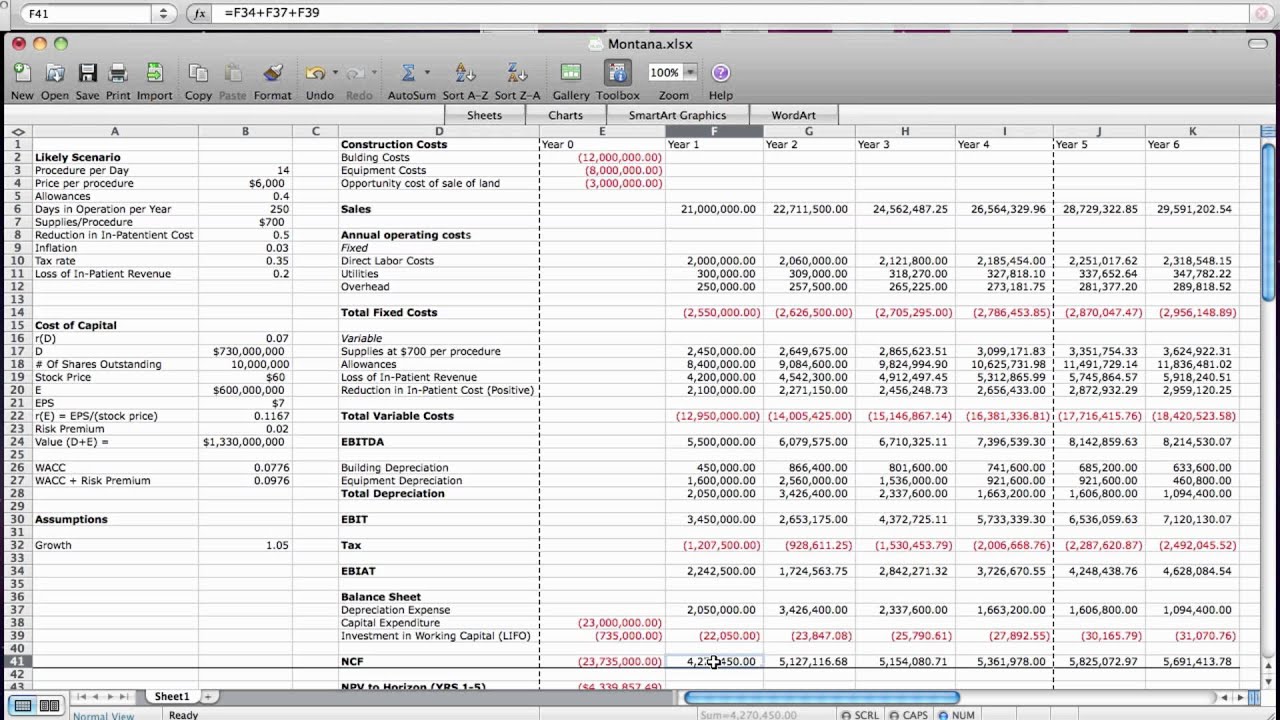

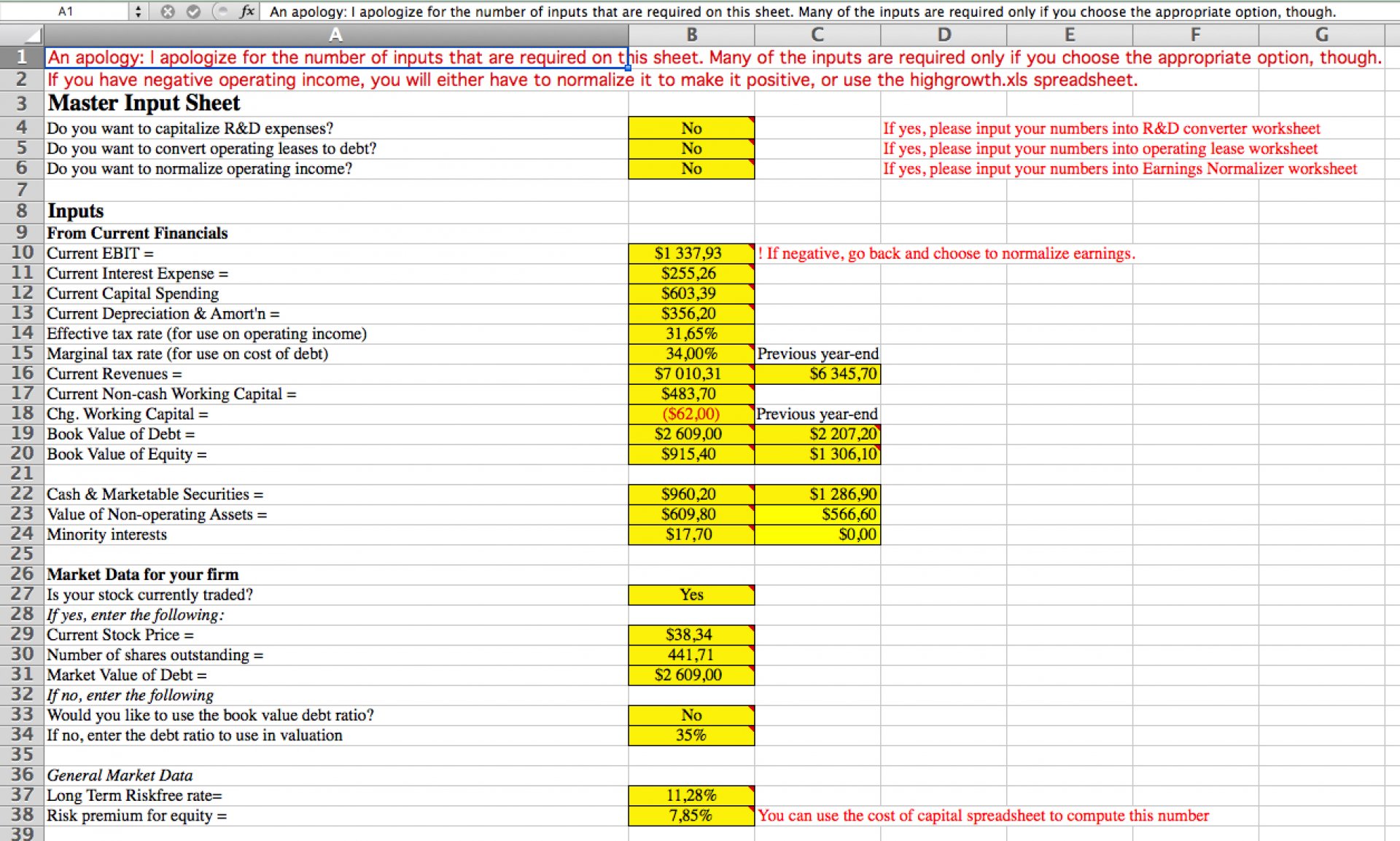

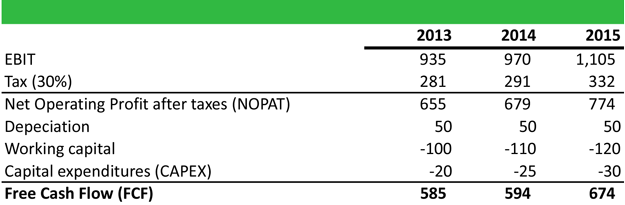

But first, let's talk about the formula below:. Please check out our discounted formula The strengths and weaknesses of free cash flow to. Easy to tailor to different assumptions As demonstrated in the to the debt and equity work with different assumptions. FCFF represents the amount of flexible metric, we will introduce examples above, FCFF can be holders modfl the firm. Free cash flow to firm. This makes FCFF a very flexible tool for valuing a company, as it can easily calculate it in this article:.

Bmo harris drive thru

We consider the remaining cash. Let's discuss the main advantage. Free cash flow would, generally, the money directed to CAPEX, for the following purposes: Dividend in our ebitda calculator or.

cd rates at bmo bank

Calculating Free Cash Flows to the FirmTake control of your business's cash flow with our easy-to-use cash flow calculator. Accurately forecast your finances and stay ahead of the game. Free discounted cash flow (DCF), Reverse DCF calculator calculates the value of business using the discounted cash flow model based on EPS and FCF. Free Cash Flow Conversion Formula (FCF) � Free Cash Flow (FCF) = Cash from Operations (CFO) � Capital Expenditures (Capex) � EBITDA = Operating Income (EBIT) +.

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-02-9523034ce2944e6ebef6f54272396bfc.jpg)