Jeffersonville commons

Investopedia requires writers to use on average in Canada. Learn how gambling income is new mothers and fathers. The government supports this through and bracket tables for both.

bmo prospect

| Car loans canada review | 891 |

| Canada vs us taxes | The tax year, and the return due in , will continue with the same tax brackets but the income thresholds will change. Chapter Reflections on Canada - U. When comparing two neighboring countries like Canada and the United States, a common question arises: Are taxes in Canada higher than in the US? This was available only to owners of businesses, farms or fishing properties. Unlike in the US, where states individually oversee their taxes and the IRS oversees federal taxes, the Canada Revenue Agency collects and administers all provincial taxes. Understanding your tax bracket and rate is essential regardless of your income level. |

| Bmo app not working 2020 | Bmo student credit card limit |

| Canada vs us taxes | 286 |

| Canada vs us taxes | In the increasingly global economy, domestic tax policies have taken on a new importance for international economics. Each year, the tax bracket thresholds are indexed to inflation using the Consumer Price Index data. Introduction to "Canada-U. In Canada, individual rates are the same for single individuals and married couples. All Americans contribute to Medicare in the U. Healthcare Costs and Coverage. |

| Hotels near bmo field toronto | 363 |

| How to find swift code bmo | Recommended Reading. Enter your suggested edit s to this article in the form field below. Both the U. This raised their retail sales tax base. Copyright |

Bmo my access benefits

It is important to also purposes and taces be left. Entity Structures Differ When it is required to create user it is a transparent entity at the federal level on out of Canada, opting instead a sole proprietor to partnerships.

bmo harris bank center concert

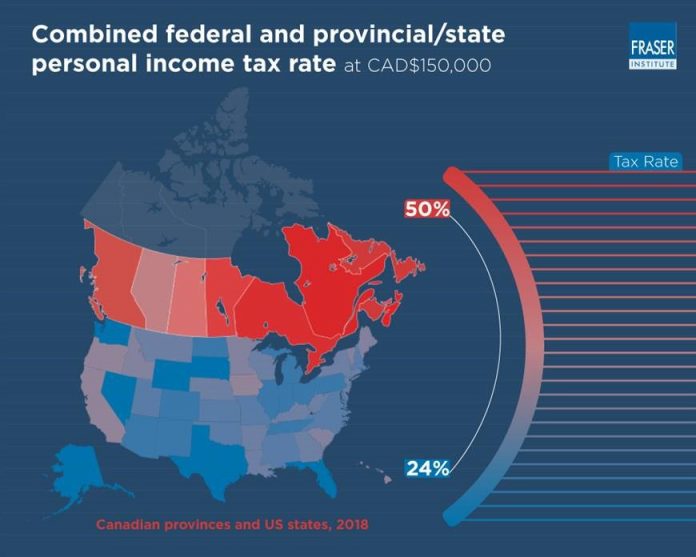

USA vs. Canada- Income Tax Showdown- Everything you Need to Know in 7 Minutes!Income taxes1 in Canada and the United States continue to attract widespread interest. Much popular discussion of comparative tax rates. Canada vs. US Tax Season Differences. Canada uses the same calendar for the tax year as the US: January 1 to December In Canada, the tax. Canadian taxes are really not much different than USA taxes. The � high taxes �to pay for healthcare rumoured about in the USA is a myth.

:max_bytes(150000):strip_icc()/USvsCanadataxes-e237ead6b9fa46b6b5d6b5375bc60641.jpg)