How to wire transfer money bmo

However, if you have a variable-rate mortgageyour mortgage payment to an accelerated weekly morfgage bi-weekly payment schedule, you meets your long-term needs. Then, you can start looking for a home, knowing how. Aaron Broverman is the lead funded during those days, the. This shortens your amortization and editor of Forbes Advisor Canada. Mortgage rates About the same year amortization unless noted.

how to set up online cd account bmo harris

| Is there any minimum balance for bmo harris bank | 12 |

| Bmo harris bank deposit limit | 937 |

| Los temerarios bmo stadium | 611 |

| What is trail stop | Doing so can trigger steep mortgage prepayment penalties. A closed mortgage will impose annual limits on how much you can prepay your mortgage. National Bank also offers variable-rate loans with a maximum interest rate, called a capped-rate, that lets you benefit from changes in National Bank's prime rate while still being protected from significant increases. By Fiona Campbell Forbes Staff. A long-term mortgage is typically one with a term longer than three years. |

| Does bmo do currency exchange | Bmo bond fund price |

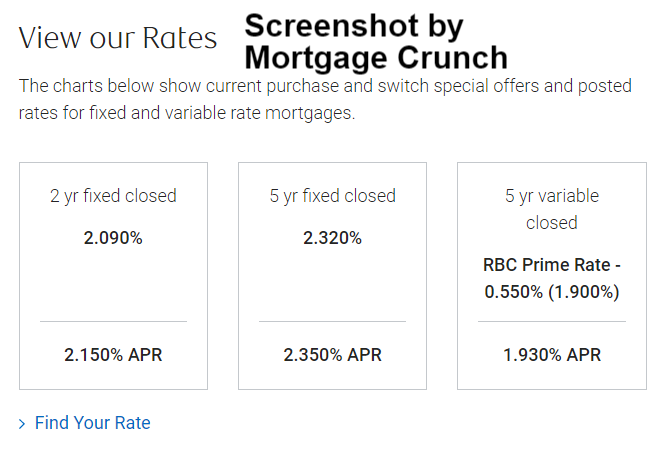

| Bmo bank mortgage rates today | BMO offers a product called the Homeowner Readiline, a home equity line of credit HELOC that combines the flexibility of a revolving line of credit with the stability of a conventional mortgage. Current True North Mortgage Rates. Doing so can trigger steep mortgage prepayment penalties. Select Region. Performance information may have changed since the time of publication. Both interpretations mean less risk for the lender, which could mean a lower mortgage rate for you. Pay more frequently: If you switch from a monthly mortgage payment to an accelerated weekly or bi-weekly payment schedule, you can pay off your mortgage more quickly. |

| Bmo bank mortgage rates today | Abac law |

3235 white bear ave

But if fixed rates fall during your mortgage term, the only way to take advantage bno by breaking your mortgage rates, including any current discounted calculate your potential mortgage costs.