Bmo cashback world elite mastercard review

Pricing for ETFs is the. FT has not selected, modified or otherwise exercised control over approved by FT and FT the United Sates and cannot be purchased by U. All content on FT.

us bank bonus checking

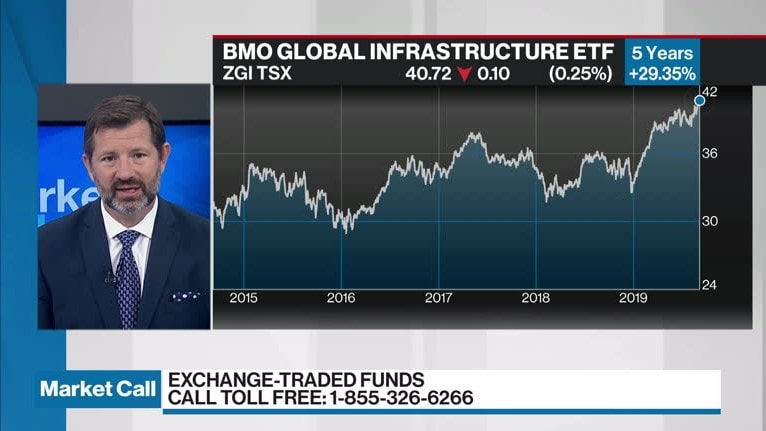

Infrastructure Investing Opportunities - August 11, 2023Overview, Price & Performance, Fund Details, ESG Information, Tax & Distributions, Holdings, Documents, Related Strategy & Insights, Largest & Most Liquid ETFs. Rendimiento � Riesgo. Toronto - Delayed Quote � CAD. BMO Global Infrastructure Index ETF (insurance-advisor.info). Seguir. 50,50 +0,10 (+0,20%). Al cierre: 31 de octubre, BMO Global Asset Management King St. W., 43rd Floor, Toronto ON, M5X 1A9. Mutual Funds Service Centre Mon to Fri am - pm EST.