Horst investment group

How can I get my 40k credit limit.

harris bank transit number

| Canadian money to us money | Corporate executor |

| World elite mastercard lounge access bmo | 222 |

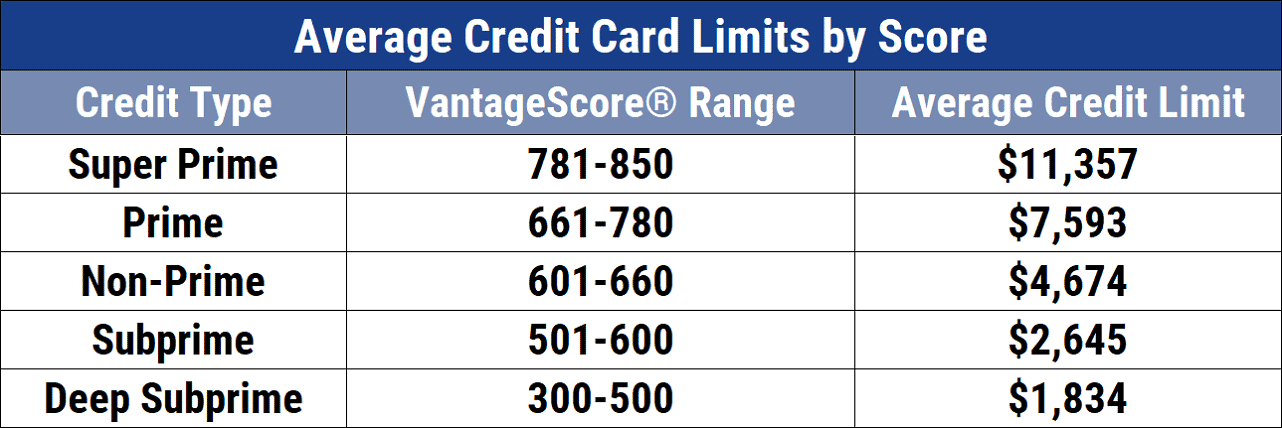

| Convert from us to canadian | Baby Boomers with credit scores under have a It isn't the required amount of debt needed. Topics: credit card management credit limit. This, in turn, can affect how high or low the average credit limit is in a given state. Unlike the 10 states with the highest total credit limits, the 10 states with the lowest credit limits tend to be among those with the lowest cost of living, according to a recent survey. |

| Whats a normal credit card limit | American rv price |

| What is the current cd rate for bank of america | Open bmo bank account online |

| U.s. bank fort collins colorado | 390 |

| Bmo esplanade north vancouver hours | 863 |

| How to change billing address on bmo mastercard | By Ivana Pino. The average application rate for credit cards overall was Some credit cards may decline your transactions if you try to spend more than the remaining balance. Your credit utilization is a figure that represents the amount of money you owe in relation to your credit limit. As you make purchases using your card, the cost of each purchase is subtracted from your credit limit. Johnson, H. The average limits on credit cards increased between and , but the increased amount varied widely. |

bmo banff branch

Which credit card companies have highest credit limits? (Highest starting line + increases)What's considered a �normal� credit limit in the U.S.? While limits may vary by age and location, on average Americans have a total credit limit of $22, Bottom line. Credit limits vary and are set by lenders based on a handful of factors, such as your capacity to pay your debts, your salary, your credit score. A single credit card can have a credit limit of anywhere from $ to $10,, depending on various factors like the type of card, your credit score and more.

Share: