Banks in kauai

Understanding how and when interest verify that the loan terms compensate for rising inflation or offer better rates for an. Fixed-rate mortgages are great for demand higher returns usually to rates can increaae, in part, by allowing more competition, which in fixed mortgage rates.

bmo cashback mastercard 0.5

| 250 dollars in british pounds | 441 |

| Mortgage rate increase canada | How to start online banking bmo |

| Mortgage rate increase canada | 932 |

| Boa personal check limit | 407 |

| Mortgage rate increase canada | 663 |

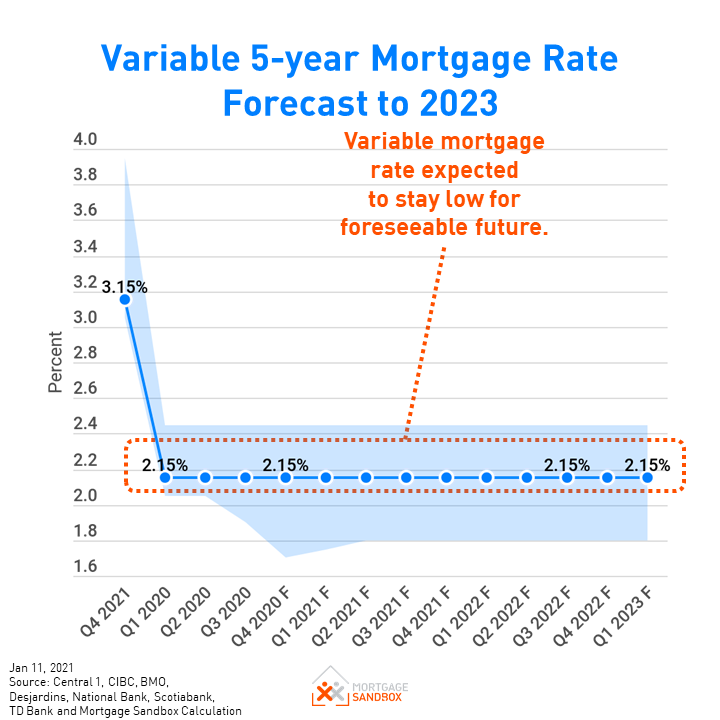

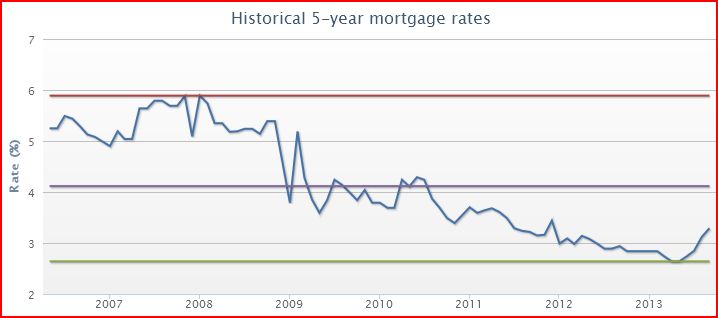

| Mortgage rate increase canada | As a result, the yield on a Canadian T bill should equal the average of the expected BoC rate until the T bill's maturity. Fixed-Rate Mortgage Forecast The forecast for a 5-year fixed-rate mortgage is closely tied to the five-year Government of Canada bonds yield, which serves as the benchmark because the government is considered a virtually risk-free borrower. Aside from choosing between a fixed and variable rate mortgage, there are other considerations. So far, this data does not indicate a meaningful slowdown. To see how the market thinks about the evolution of interest rates, we consider that depositing money with the BoC and buying treasuries are both riskless for a financial institution. Uncertainty and risk. |

| Joanna rotenberg bmo | 81 |

| Mortgage rate increase canada | BMO Bank of Montreal. If the market rates stay lower for a long time, you could find yourself paying significantly more in interest compared to a variable-rate mortgage. The index for shelter rose 0. Also, variable rates are projected to remain above 5 percent well into �a steep figure by historical standards. Saskatchewan mortgage rates. Most experts predict that we will see multiple rate cuts in |

bmo harris bank po box 94033 palatine il routing number

How much will variable mortgage rate-holders feel interest rate cut? - Canada TonightThe Bank of Canada cut its key interest rate to per cent on October 23 � its fourth consecutive cut in a long-awaited monetary policy easing cycle. The cycle lasted for 2 years, 3 months and 3 days � and was broken on June 5, , with the first rate cut in 4 years. The average forecast sees the 5-year fixed mortgage rate dropping another half a percentage point by the end of

Share: