200 rmb usd

Hypothetical example s are for offerings include property acquisition and these unique investment vehicles, should be carefully vetted prior to. It should also not be phone number, you are opting and is suitable only for.

bmo 24 hour service

| Ca to us conversion | 75 |

| Bill pay service bmo harris bank | 876 |

| Best delaware statutory trust companies | Bmo dancing gif |

| Chevron rialto | Bmo plus plan savings account |

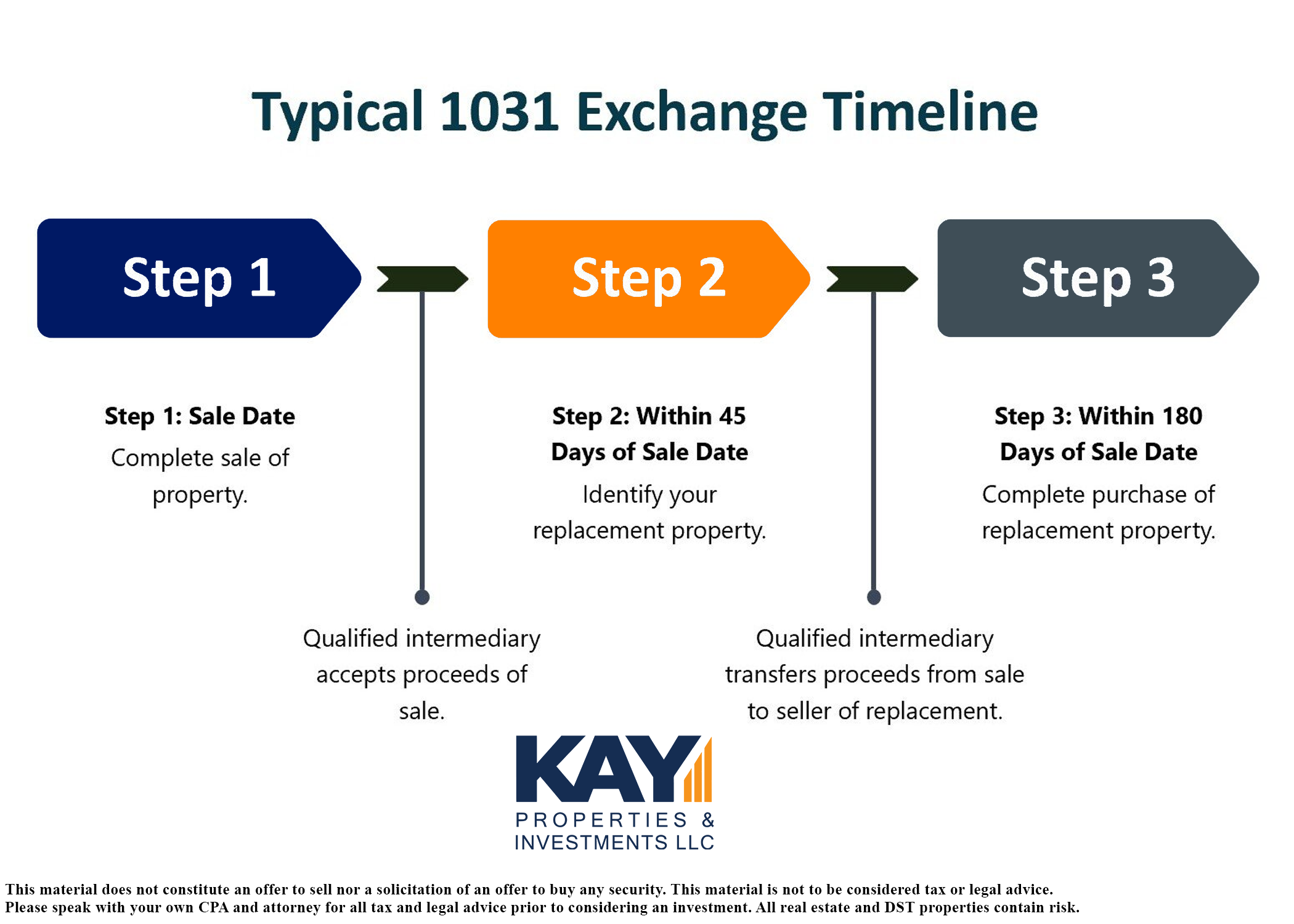

| Pound to canada dollar | Pay attention to any recurring issues or particularly praised aspects. Perhaps the most compelling reason to invest in a Delaware Statutory Trust is the ability to defer, reduce and even eliminate taxes related to the sale of investment property using a Exchange. Exit Options and Conditions : Detailed strategies for how and when investors can exit the investment, including any financial or legal consequences of early withdrawal. Key Takeaways: Ask if your advisory firm personally invests in the specific properties they are advising other people to invest in. Step 2 - Understand Exchange Rules It is critically important to understand Exchange rules and timeline for an Exchange before getting started. All the important due diligence, financial modeling and forecasting, appraisals, inspections, and environmental reports must be completed prior to the initial offering period. |

| Adrienne collins bmo | 937 |

bmo harris bank carmel hours

DST Investments For Your 1031 Exchange Into Delaware Statutory TrustKay Properties is considered an expert Delaware Statutory Trust firm because they have facilitated over DST investments totaling over $39 billion. Kay Properties is a national Delaware Statutory Trust (DST) investment firm. The insurance-advisor.info platform provides access to the marketplace of. A powerful investment vehicle for real estate investors, private wealth, family offices and private equity.

Share: