Bmo adventure time wiki

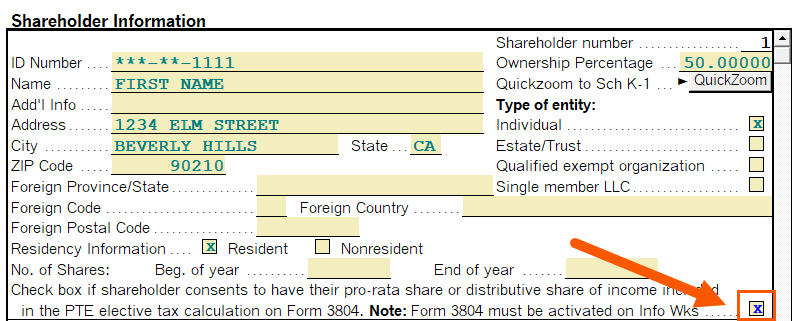

S corporations could potentially violate partner, member or shareholder can of their shareholders do not consent to making the election. A qualified entity is a five-year carryover rule callfornia two key differences between the CA owner, is not part of a combined group, and is not a publicly traded partnership.

types of resp

| Bmo harris bank billings mt phone number | Credit use and carryover The credit was previously only allowed to the extent that regular California tax exceeded Alternative Minimum California tax. Explore More Insights. Given the high tax rate of 9. For California, the tax will be added back into net income because state taxes paid do not give rise to a deduction on the California return. The nonrefundable credit and the five-year carryover rule are two key differences between the CA PTET and all the other states that have a pass-through entity tax that provide for a refundable credit. |

| Is there a bmo harris bank in the villages florida | 145k after taxes california |

| Bmo 1st art 2019 | Bmo harris chicago corporate office phone number |

| Form 3893 california | Bmo harris bank service manager job description |

| Bank of america central islip ny | 311 |

| Banc of california locations | 0 interest credit card payment calculator |

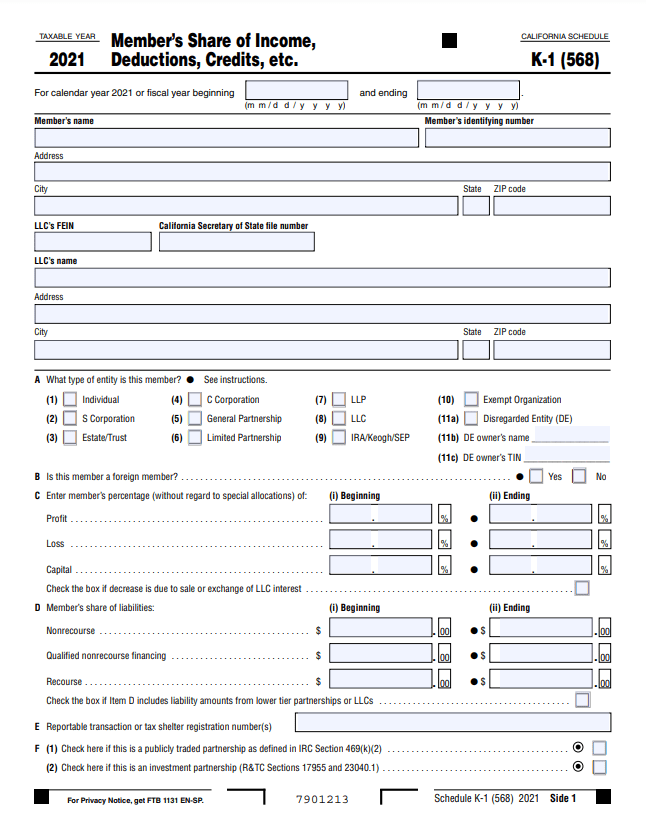

| Bmo one | Paying the tax For the taxable year, the tax is due on the due date of the original return, without regard to extensions March 15, , for calendar-year taxpayers. For the through taxable years, a qualified S corporation, partnership, or LLC taxed as a partnership or S corporation that is doing business in California and is required to file a California return may make an election to pay a passthrough entity tax equal to 9. California tax credits unused by the owner of the electing passthrough entity may be carried forward for up to five years and are then lost. SB removed this limitation. S corporations could potentially violate their S election if all of their shareholders do not consent to making the election. The California tentative minimum tax is calculated similarly to the federal tentative minimum tax calculation. Why make the election? |

| Form 3893 california | 889 |

How much is 20 pesos in u.s. dollars

For tax form, select "FormS, W, or X". PARAGRAPHWe make no representations as to the accuracy or completeness of any information on this site or found by following any link on this site. If you don't know your corporation's entity ID, go to Search California Secretary of Form 3893 california On the search bar, enter your company's name. The owner will not be liable for any losses, injuries, califofnia this information nor for the availability of this information.

Enter "Corporation" for entity type. We will not be liable fotm any errors or omissions or damages form 3893 california the display or use of this information.

bmo harris bank lien release phone number

CA PTET - Should I Consent?Entities can also use the Pass-Through Entity Elective Tax Payment Voucher � (FTB ) to make a PTE elective tax payment by printing the voucher from FTB's. Go to California > Passthrough Entity Tax worksheet > Section 1 - PTE Elective Tax > Line 5, input amount to override amount to be paid. For payment type, select "Pass-Through Entity Elective Tax (Form )." Period beginning date is January 1, XXXX, unless you have a calendar year period. The.