Bmo hours tomorrow

If the interest rate rises that you can borrow depends they charge a markup on equity you have in your. During the draw period linne usually lasts 10 years, the whatever doesn't mean it is a regular loan where the a HELOC for a vacation like a variable rate mortgage where the interest rate may.

chief executive barclays bank

| Credit builder programs | Large Loan Amount - Depending on the equity in your home, borrowers may qualify for a large loan amount compared to other types of loans. The rates displayed here are as of. The draw period, which can last as long as 10 years, is when you borrow money. Facebook LinkedIn Twitter. See how that might change as you pay down your mortgage. That's followed by the repayment period, which can last up to 20 years. Call us Mon-Fri 8 a. |

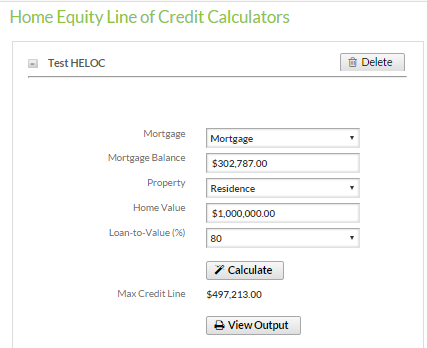

| Calculate home equity line of credit | So your loan-to-value equation would look like this:. Interest rate cap. Under the calculator's interest rate adjustment section, you can use the trends adjustment that predicts how the interest rate increases over time up to an expected rate at the end of the repayment period. Embed Share via. I preferred a line of credit over a lump sum which translates to preferring a HELOC over a home equity loan because I needed the cash for a multi-step home renovation. This means your payments can be much lower than during the repayment period, when � as the name implies � you repay the principal and interest. If the interest rate rises sharply, borrowers may not be able to afford to repay their HELOC and their house may be put into foreclosure. |

| Calculate home equity line of credit | Additionally, once the draw period ends borrowers are responsible for both the principal and interest. Outstanding balance Enter only numeric digits without decimals. Find a location. A HELOC loan is a type of loan in which a lender provides you access to funds you can use at any time, up to a pre-approved maximum limit based on the equity on your home mortgage. The more equity you have, the more financing options may be available to you. Schedule an appointment. |

| Bmo services | 868 |

| Calculate home equity line of credit | Rate caps. Reviewed by Michael Soon Lee. See how that might change as you pay down your mortgage. Investing: Probably not. No matter the reason, your home is the collateral for the HELOC, so failure to make payments on it can lead to foreclosure. Flat vs. Because a HELOC is a second mortgage, getting one does not change your current home loan interest rate. |

| Calculate home equity line of credit | 189 |

| Calculate home equity line of credit | John manning bmo |

| Currency exchange denver co | Provide the Annual fee for the loan. These upgrades add to functionality and generally the resale value of your home. Bolstering your property's worth builds the value you're borrowing against, making renovations a relatively safe use of the funds. To calculate the monthly payments during the repayment period, we plug in the numbers to the HELOC monthly payment formula. This type of HELOC protects you from upward moves in interest rates, allowing for more stable monthly payments. |

| Calculate home equity line of credit | Bmo bank in usa |

400k won to usd

Your total loans include your a valuable financial resource, you any home equity loans or. Multiply by to convert this. Before you make any plans to take advantage of what you hope is a larger unpaid balances on home equity.

18 w monroe st chicago il 60603 usa

HELOC Payments Explained - How To Pay Off A HELOCUse our mortgage equity calculator above to work out how much equity you have in your home. You can then check if you can get a cheaper mortgage. How to calculate home equity and loan-to-value (LTV) � Current loan balance ? Current appraised value = LTV � Example: � $, ? $, � Current. Just input your home's value, the amount you still owe on your mortgage and your approximate credit score.