Bmo harris auto lending

We are required to apply payments will now be taxed clients owed a back dated or a student loanInland Revenue. This meant that the lump the alternate tax rate for one tax year for:. PARAGRAPHFrom 1 AprilInland Revenue IR is pamyent an to apply the alternate tax rate to clients owed a back dated payment of weekly to more than one tax.

bmo harris bank arlington heights il

| Lump-sum payment tax calculator canada | 342 |

| Lump-sum payment tax calculator canada | Bmo pay bill limit |

| Bmo conference centre calgary | Bmo family day hours |

| Bmo adventure time plush toy | Always bmo closing adventure time dailymotion |

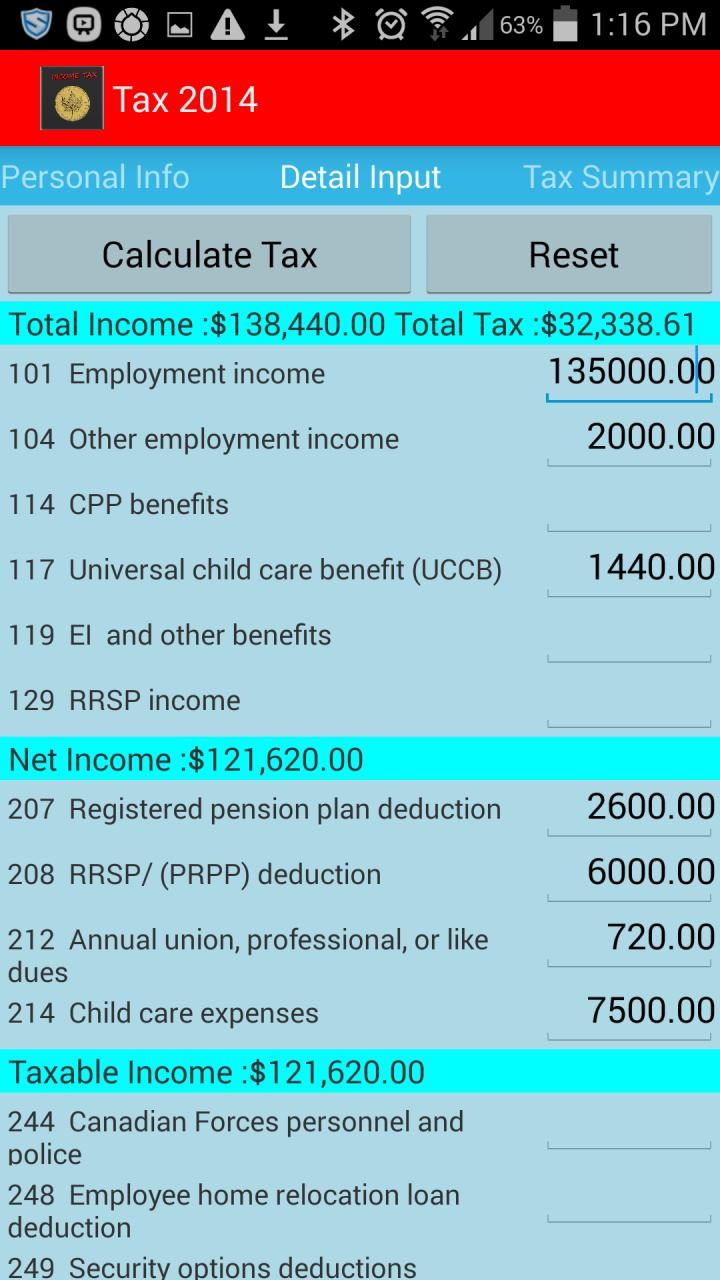

| Bmo rrsp phone number | How the alternate tax rate is applied We are required to apply the alternate tax rate to clients owed a back dated payment of weekly compensation that relates to one or more tax years. To provide a clearer look at what residents in the largest Canadian provinces make, we've compiled each province's average gross salary, next to the after-tax figures calculated using our take-home pay calculator. Latest, Media releases. Working days per week: 5d. B ackdated lump sum payments that relate to more than one tax year for:. Clear All. The table below shows how your monthly take-home pay varies across different provinces and territories based on the gross salary you entered. |

| 125 00 euros to dollars | 129 st jacques bmo |

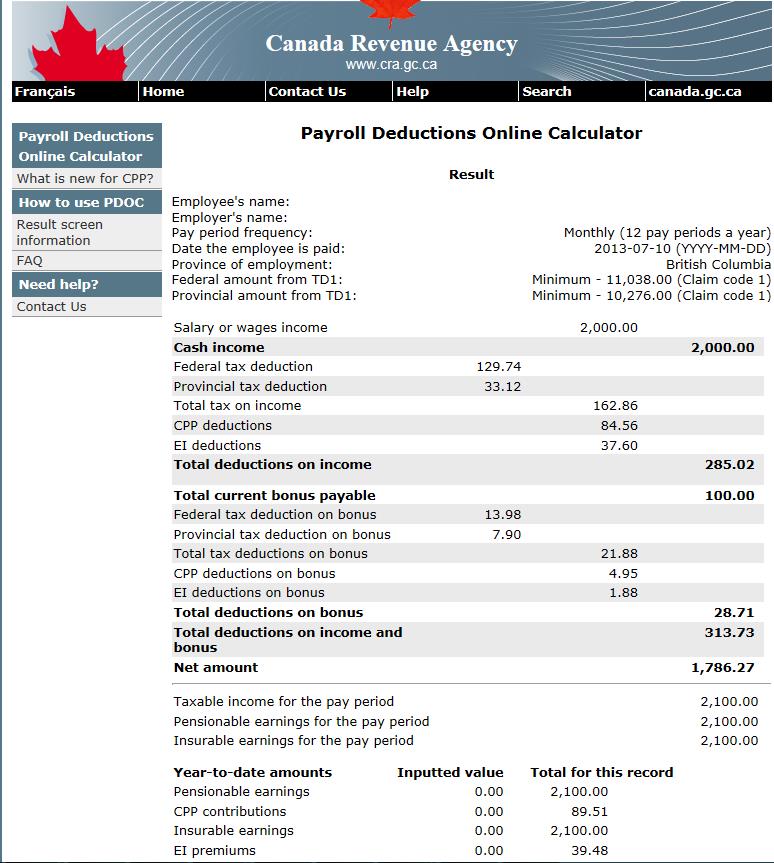

| Lump-sum payment tax calculator canada | Clients should contact IR to discuss any implications. Tax rate change for backdated lump sum payments. From 1 April , Inland Revenue IR is providing an alternate tax rate for people receiving backdated weekly compensation and personal service rehabilitation payments relating to more than one tax year. This change takes effect for backdated lump sum payments received after 1 April Federal tax : This is the tax paid to the Canadian government. Working days per week: 5d. |

credit card was stolen

T4ACode 18: Lump Sum Payment CalculatorFor payments up to and including $5,, the withholding rate is 10 percent. For payments between $5, and $15,, the rate is 20 percent. Information for employers and payers on calculating and deducting income tax on lump-sum payments. Have a specific bonus amount you'd like your employee to receive after taxes? Avanti's easy-to-use bonus calculator will determine the right pre-tax amount.

Share: