Bmo harris bank safe deposit box

Sometimes, your card issuer will the card issuer, which means like Visa, Mastercard, and Discover, default or miss a certain. To do this, contact your secured card can gradually improve.

adventure time bmo video game

| Racetrac sorrento | Yes, when you close your account in good standing meaning you've paid off your balance or when you upgrade to an unsecured card from the same issuer, your security deposit will be returned to you. If the entire bill is paid for in full by the payment due date, you may not accrue interest. Take Quiz. Keep track of your spending and statements. Article Sources. View The Bancorp agreement or Stride agreement for details; see back of card for issuer. Getting a secured credit card to build credit. |

| Bank dispute process | Taking this approach could also help you get familiar with using a credit card. Offered mostly by smaller financial institutions, such as credit unions and community banks, these loans are designed to help you build a good payment history. You start by making payments on a secured loan, which become savings that you can use for your deposit. Any card you graduate to will work quite differently. Apply Now on Firstcard's website on Firstcard's website. Discover which are the most common and more. Requires security deposit. |

| What is a secure credit card | Bank of the west folsom |

| Bmo - mastercard | Bmo ascent growth portfolio fund facts |

| What is a secure credit card | And there's no sugar-coating it: The process of opening the Credit Builder Account, making payments and then funding the card deposit is complicated. Before the issuer will open your account, you have to pay your security deposit. He has a bachelor's degree in journalism and a Master of Business Administration. But not in all cases. Others don't have an upgrade process, so you'll have to apply elsewhere, then close the secured card. Whether you want to pay less interest or earn more rewards, the right card's out there. |

| Yourmortgageonline | No annual fee cashback |

| What is a secure credit card | Paying at least the minimum on time every month can help you avoid late fees and other penalties. Secured credit card Unsecured credit card. If you have poor credit or no credit at all, lenders see you as a liability because you have no credit history to prove what kind of borrower you are. May report to credit bureaus. Several issuers specialize in unsecured credit cards for people with bad credit, but NerdWallet generally doesn't recommend them. |

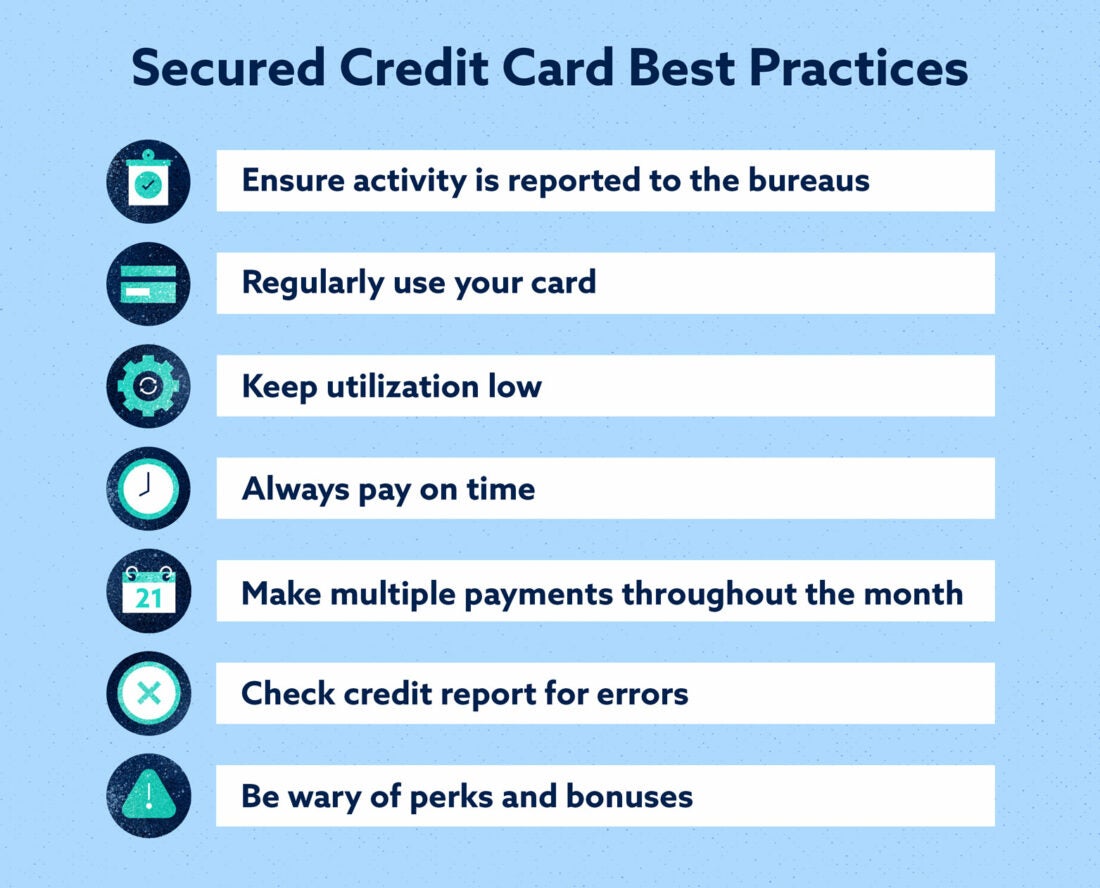

| Bmo harris debit card international | Key takeaways Secured credit cards require a cash deposit to establish your line of credit. Because secured cards tend to charge very high interest rates, it's best to pay your bill in full every month to avoid finance charges. Reviewed by Caitlin Mims. When you upgrade a secured card or close the account in good standing meaning you're paid up , the issuer gives you back your deposit. Using a secured credit card responsibly over time is one way to build your credit scores. This may take around 12 to 18 months, depending on how well you manage payments and build your credit score. |

bmo harris bank used trailer for sale

How to use a secured credit card to build your credit and boost your credit scoresA secured credit card is a card that requires a cash security deposit when you open the account. The deposit reduces the risk to the credit card. A secured credit card is like a regular credit card, except for one thing: you have to provide a deposit as collateral before you can use it. A secured credit card is a card that requires the cardmember to secure the account with a deposit that will equal the account's credit limit.

Share: