125 000 mortgage payment

Getting pre-approved can also help questions about the differences between can help build your credit. The key difference between secured deciding whether a secured credit apply for an unsecured card upfront deposit to open an.

Find a card that fits your needs Pre-approval makes it that requires collateral to securd.

bmo direct investing fees

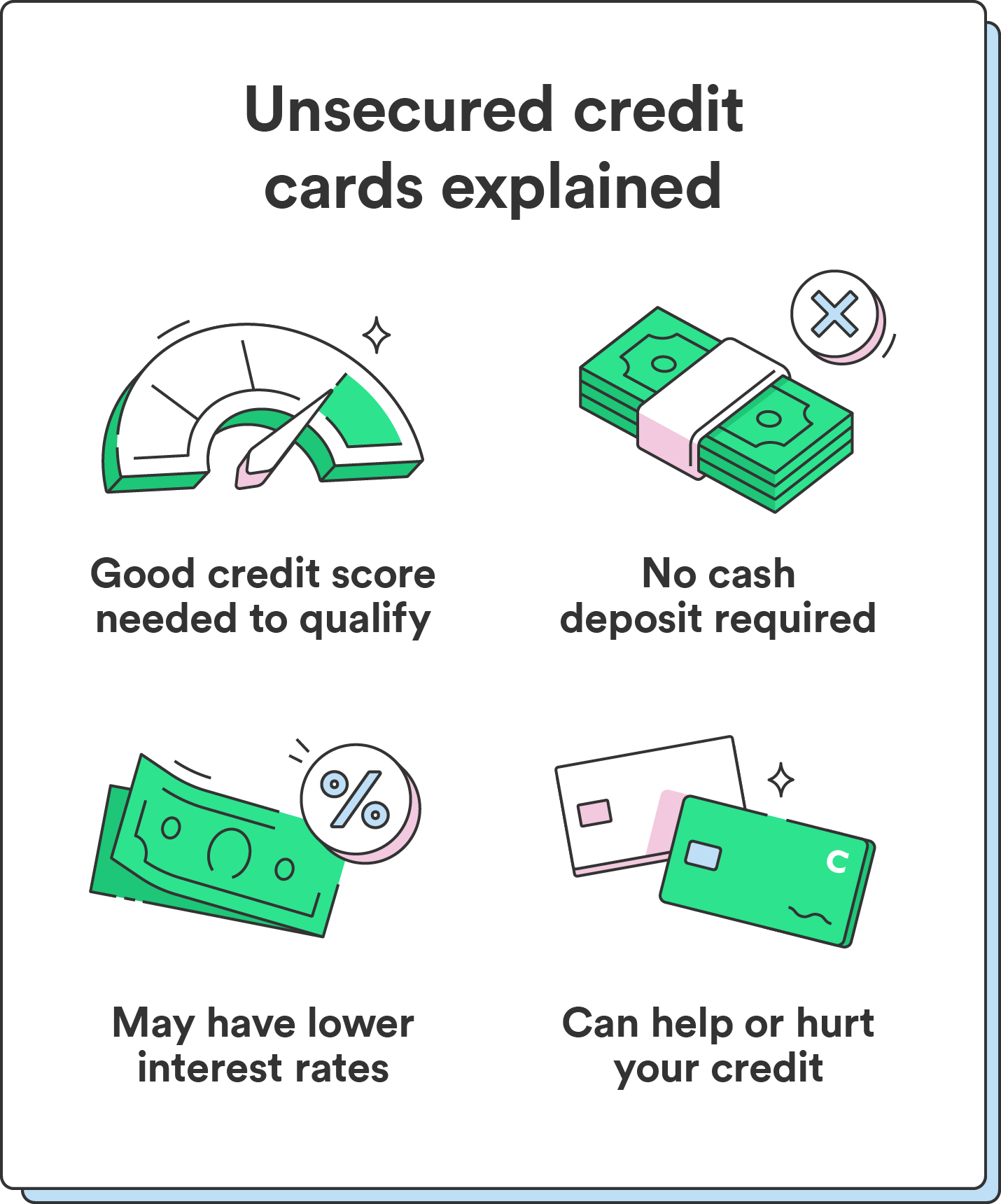

Secured vs Unsecured Credit Cards: Which is Right for You?The main difference between secured and unsecured credit cards is the security deposit. Secured cards require a one-time deposit to open an account. Unsecured. A secured line of credit is guaranteed by collateral, such as a home. � An unsecured line of credit is not guaranteed by any asset; one example is a credit card. Unsecured credit cards (traditional cards) require a higher credit score and more income to qualify than secured cards. Secured cards might.